Owning a timeshare can be a great way to ensure you always have a vacation planned, and an adventure waiting for you and your family. While there are many different types of timeshares available, a weeks-based Marriott timeshare is an extremely cost-effective option that many people shopping for their ownership on the resale market find advantageous.

In this article, we’ll be showing you how to calculate the savings of owning a Marriott week for yourself, share examples showing how much money you could save by owning a Marriott legacy week, and we’ll discuss a few of the other benefits that come with this type of ownership.

If you’d like to jump to a section that interests you most you can select any heading in the table of contents below.

Table of Contents

Understanding Weeks-Based Marriott Timeshares

Before we delve into the cost savings, it’s important to understand what a weeks-based Marriott timeshare is. Essentially, you purchase a floating week at a specific property that can be used in perpetuity to travel to your deeded destination. This means you have a guaranteed spot for your vacation during your season (deeded range of weeks) for the rest of your vacationing lifetime.

Marriott is one of the leading hospitality companies, and there is a healthy resale market for weeks-based timeshares, with properties located all around the world that can be purchased for as low as just a few thousand dollars. This means you can choose a location that suits your travel preferences and enjoy the comfort and amenities that come with a Marriott property.

If you’d like to learn more about how weeks-based Marriott timeshares work on the resale market, you can read the section on Marriott legacy weeks in our in-depth article here: How To Buy A Marriott Timeshare Resale: The Definitive Buyer’s Guide.

Considering The Factors

Now, let’s get down to the nitty-gritty: the factors that determine your overall cost savings. In order to perform the calculations in this article, you will need to first establish a few of the numbers regarding your specific situation. We will need to define the following numbers:

Initial Purchase Price

The initial purchase price of your Marriott legacy week can vary based on the exact property you purchase. Below are the main attributes of the ownership that determine the property’s value on the resale market.

Weeks-based Marriott timeshares, also known as legacy weeks, are deeded property that conveys usage to the owner for a one week vacation in a specific unit type, at your specific home resort, during a specific season (floating week), with a specified view (if applicable to your chosen home resort). Usage rights can be granted every year, which is referred to as annual usage, or every other year, which is referred to as biennial usage, depending on what fits your travel needs best.

Annual Dues

When calculating cost savings, we also have to factor in maintenance costs of your Marriott ownership which vary depending on the resort you own. Currently, the maintenance fees can range from as little as $700 to as much as $3,000 each year. Your maintenance fees are largely determined by the home resort and unit size you purchase, and are a factor in determining the overall savings of owning a Marriott week.

Years Of Vacations

The number of years the timeshare will be used can depend on when in your life you purchase the timeshare, and how many years you intend to travel using the ownership.

How To Calculate The Cost Savings Of Your Marriott Ownership

Here’s how you can calculate the potential savings of a weeks-based Marriott timeshare.

Step 1

Initial Purchase Price ÷ Years Of Vacations = Yearly Initial Cost

Step 2

Yearly Initial Cost + Annual Dues = Total Annualized Cost Per Week

Step 3

Total Price Paid To Marriott for Comparable Reservation (make sure to include taxes) – Total Annualized Cost Per Week = Total Annual Savings

Step 4

Total Annual Savings x Years Of Vacations = Total Lifetime Cost Savings

Using Examples To Calculate Potential Savings

Now that we’ve established what information is needed, and the formula for deriving the potential savings of owning a Marriott week, let’s explore a few fictional scenarios to give you a few examples. Simply click to expand the sections below to explore the savings for that particular scenario.

Scenario #1

Assumptions

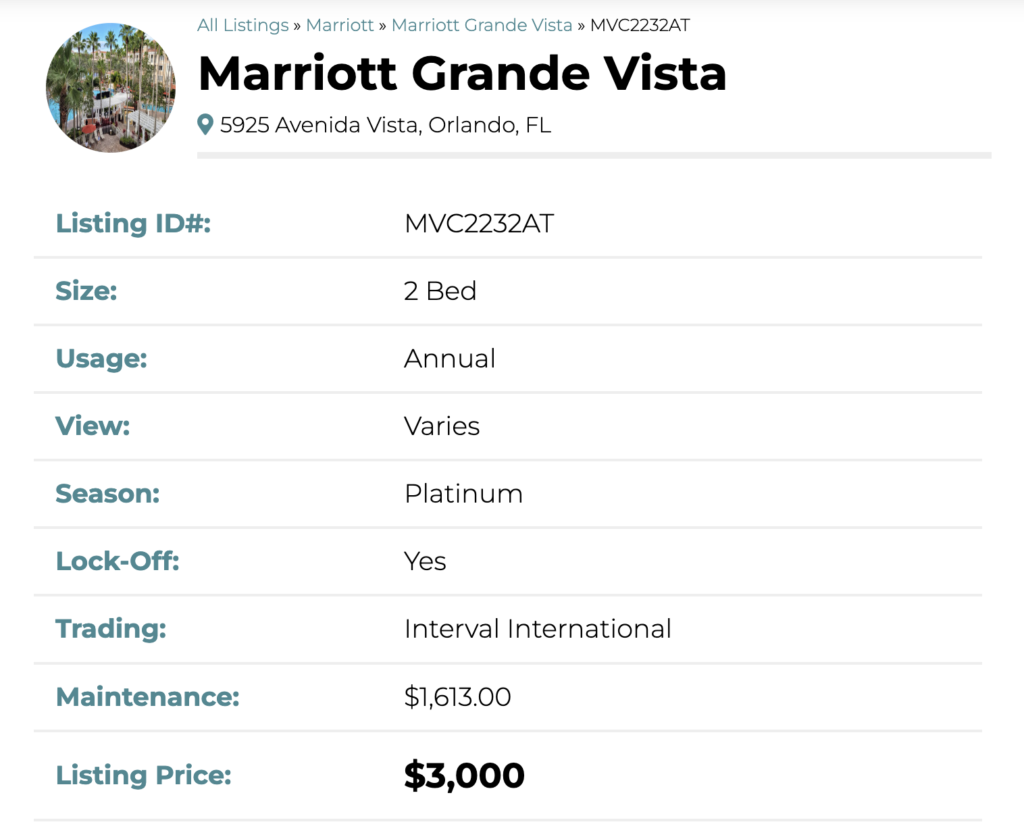

In this scenario, we’ll be using Grande Vista as our home resort. We’ll be assuming that you’ve purchased a week in a 2 Bedroom Villa, during this resort’s Platinum season. We’ll also be assuming that you’ve purchased this ownership at age 30, and intend to travel using the timeshare until age 60.

Currently, we have this ownership listed on our website for approximately $3,000 to $4,500. Let’s assume your initial purchase price is $3,000.

Finding Total Annualized Cost Per Week

In this case, we take the $3,000 initial purchase price, divided by the 30 years you will use the ownership to travel, we have $100 per year in Yearly Initial Cost.

We also need to factor in the $1,613 per year in annual maintenance fees, and add that to the Yearly Initial Cost.

This brings us to approximately $1,713 for our Total Annualized Cost Per Week.

Finding Total Annual Savings

When we pick a random week that is within the Platinum season, and find a comparable reservation, we find that it would cost about $2,234.70 to book this reservation with Marriott.

$2,234 (price of comparable reservation with taxes) – $1,713 (Total Annualized Cost Per Week) = $521 (Total Annual Savings)

Finding Total Lifetime Savings

$521 (Total Annual Savings) x 30 (Years Of Vacations) = $15,360 (Total Lifetime Savings)

Scenario #1 Conclusion

Over the course of using this timeshare, you would stand to save over $15,000 dollars.

A few other considerations to keep in mind would be that historically maintenance fees have not risen as quickly as hotel costs. Also, at the end of the 30 years, you would still be able to sell the ownership and recoup some the cost that was initially paid to purchase the ownership.

Additionally, there are expert tips you can find on our blog to further maximize the value of the ownership, travel to literally thousands of other destinations using timeshare exchange, and for this particular property, you have the ability to use the lock-off feature which turns your one week in a 2 bedroom into one week in a studio, and an additional week in a 1 bedroom.

Scenario #2

Assumptions

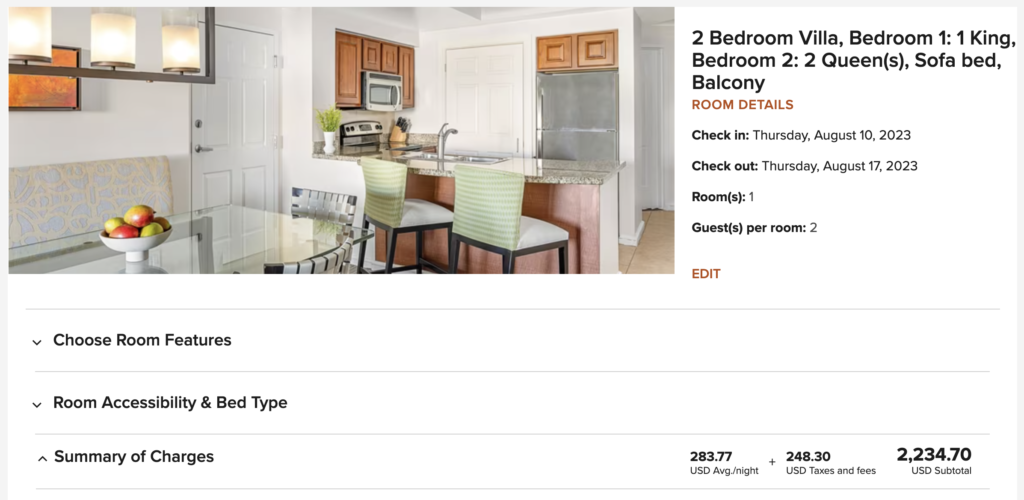

In this scenario, we’ll be using Kauai Beach Club as our home resort. We’ll be assuming that you’ve purchased a week in a 1 Bedroom Villa, during this resort’s Platinum season. We’ll also be assuming that you’ve purchased this ownership at age 30, and intend to travel using the timeshare until age 60.

Currently, we have this ownership listed on our website for approximately $4,500 to $6,100, depending on the view type you want to purchase. Let’s assume you chose to purchase a garden view unit, and your initial purchase price is $4,500.

Finding Total Annualized Cost Per Week

In this case, we take the $4,500 initial purchase price, divided by the 30 years you will use the ownership to travel, we have $150 per year in Yearly Initial Cost.

We also need to factor in the $2,600 per year in annual maintenance fees, and add that to the Yearly Initial Cost.

This brings us to approximately $2,750 for our Total Annualized Cost Per Week.

Finding Total Annual Savings

When we pick a random week that is within the Platinum season, and find a comparable reservation, we find that it would cost about $4,549.79 to book this reservation with Marriott.

$4,550 (price of comparable reservation with taxes) – $2,750 (Total Annualized Cost Per Week) = $1,800 (Total Annual Savings)

Finding Total Lifetime Savings

$1,800 (Total Annual Savings) x 30 (Years Of Vacations) = $54,000 (Total Lifetime Savings)

Scenario #2 Conclusion

Over the course of using this timeshare, you would stand to save over $54,000 dollars.

At the end of 30 years, you will still own the property and be able to sell it to recoup money on your initial purchase price if you choose to do so.

Other Benefits Of Owning Marriott Vacation Club

Factoring In The Stability Of Pricing

One of the biggest advantages of a weeks-based timeshare is the stability of pricing. With a timeshare, you lock in your accommodation costs for years in advance. This can protect you from inflation and rising hotel prices, potentially saving you a significant amount of money in the long term.

Thinking About The Value Of Guaranteed Vacations

Another factor to consider is the value of guaranteed vacations. Knowing you have a set week or weeks each year where you can escape to a vacation property can be incredibly valuable. It encourages you to take regular vacations, which can be beneficial for your mental health and overall well-being.

Don’t Forget The Potential For Exchange

Marriott’s timeshare program also includes the ability to exchange your weeks for stays at other Marriott properties worldwide. This can provide immense value if you like to explore new Marriott Vacation Club destinations, or literally thousands of other resorts that are affiliated with Interval International.

Using timeshare exchange can provide you an incredible amount of flexibility and value. If you’d like to learn more about maximizing the value of exchanging a Marriott week, you can learn how to buy the perfect Marriott week for trading purposes, what fees are required to exchange, and how to double your vacation time by reading our article here: Buying A Marriott Legacy Week To Trade With Interval International.

Conclusion

Calculating the cost savings of a weeks-based Marriott timeshare involves more than just comparing the upfront cost to the cost of annual hotel stays. You must also consider the long-term price stability, the value of guaranteed vacations, and the potential for exchanges. While the specifics will vary depending on your travel habits and preferences, many people find that a Marriott weeks-based timeshare offers significant value and savings.

Learn More About Marriott Timeshare Resales

We hope you found this article helpful in providing you with the information you need to make an informed decision about purchasing your Marriott timeshare resale.

If you’d like to continue learning about the wide world of Marriott timeshares, you can read through our extensive archives of Marriott timeshare articles that walk you through using your timeshare like a pro, understanding the finer points of the booking system, and keep you up to date with any new developments.

Contact Us For Assistance Today!

If you have any further questions about Marriott timeshares or would like to start shopping to buy a Marriott timeshare, please don’t hesitate to contact us. We’re always happy to help!